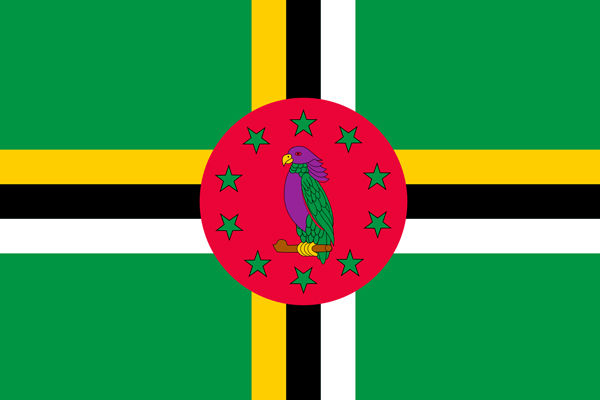

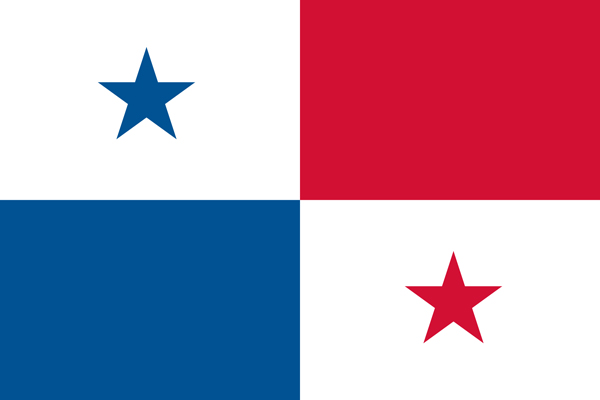

Vanuatu

About that flag :

Vanuatu, officially the Republic of Vanuatu, is an archipelago in the South Pacific Ocean, east of Australia west of Fiji

and North of New Zealand, consisting of a chain of 13 principal and many smaller islands.

When it comes to offshore businesses and tax havens, Vanuatu ranks among the most popular. In fact, it features amongst the

most sought out locations such as the BVI, Bermuda, Cayman Islands and Jersey.

An Offshore or International Company, is commonly set up in an offshore financial centre like Vanuatu, where there are no

corporate or personal income taxes, capital gains taxes, reporting requirements, or restrictions on company employment policies.

As tax laws differ from flag to flag it is important to seek proper professional advice in your home flag to ensure that any use

of Vanuatu does not infringe the laws of another flag.

The main restriction is that the company, being exempt from all local taxes and restrictions, may not conduct business within the Vanuatu itself.

International companies have several advantages; they can offer complete privacy, for instance if the company shares are held by a

trust, the ownership is legally vested in the trustee, thus gaining the potential for even greater tax planning. International

companies are widely used vehicles for holding various investments such as property, shares, patents, etc. and can also be

useful in operating trading businesses. Both their tax free status and the secrecy provisions embodied in the legislation,

makes this type of company attractive to individuals and established companies alike.

Company structure :

-

Only one shareholder (can also be a legal person, no nationality restriction or residency restrictions)

-

Only one director (can also be a legal person, no nationality or residency restrictions)

Company structure :

-

Beneficial owners' details – Not part of public record

-

Shareholders' details – Not part of public record

-

Directors' details –Not part of public record

Taxation :

Vanuatu International Company is exempt from all forms of taxation in Vanuatu

Other benefits :

There is no legal requirement for Annual General Meetings to be held. Directors and Shareholders can vote by Proxy.

Meetings can be held anyway in the world thus do not have to be in Vanuatu. If held outside Vanuatu, meeting can be made

through telephone, or other means.

Accounting requirements :

Annual Returns or Audited accounts are not required to be filed with the authorities. However, it is necessary for the

companies to maintain financial records that reflect the company’s financial situation.

Secretary :

Optional, although it is customary to have one

Registered Agent :

Required

Registered office :

Required

Company Name :

-

Language : Any

-

Letters : Any

-

Company name must end with such sufixes or their abbreviations: Limited, Corporation, Incorporated, Societe Anonyme,

Sociedad Anonima, Sendirian Berhad, Societe a Responsabilite Limitee, Besloten Vennootschap, Gesellschaft mit

beschrankter Haftung. An International Company may utilise a broad range of internationally accepted abbreviated

words as suffixes to denote their limited liability

-

Names Requiring Consent or a Licence: Bank, buildings society, insurance, assurance, reinsurance, fund management,

investment fund, trust, trustees, finance N.B.

-

No Double Taxation TreatiRestricted connections for company name: name of state, national or local government.es or sharing of

trading activities

-

Any name that implies illegal activity or implies royal or government patronage is restricted.

-

Registrar may reject any name which it considers undesirable or contrary to the public interest.

-

Company name is restricted to be identical or similar that of an existing company.

-

In case when foreign language is used for company name the translation must be provided to Registrar which will ensure conformity to above listed restrictions.